Wise (formally TransferWise) recently brought out its new Borderless Account which could be very helpful for investors who have diversified investments in multiple countries and currencies. It’s also great for anyone who travels internationally.

Wise have been around for a while offering international currency exchange and transfer services. They’ve been known for their low exchange rates and “beating the bank” exchange fees.

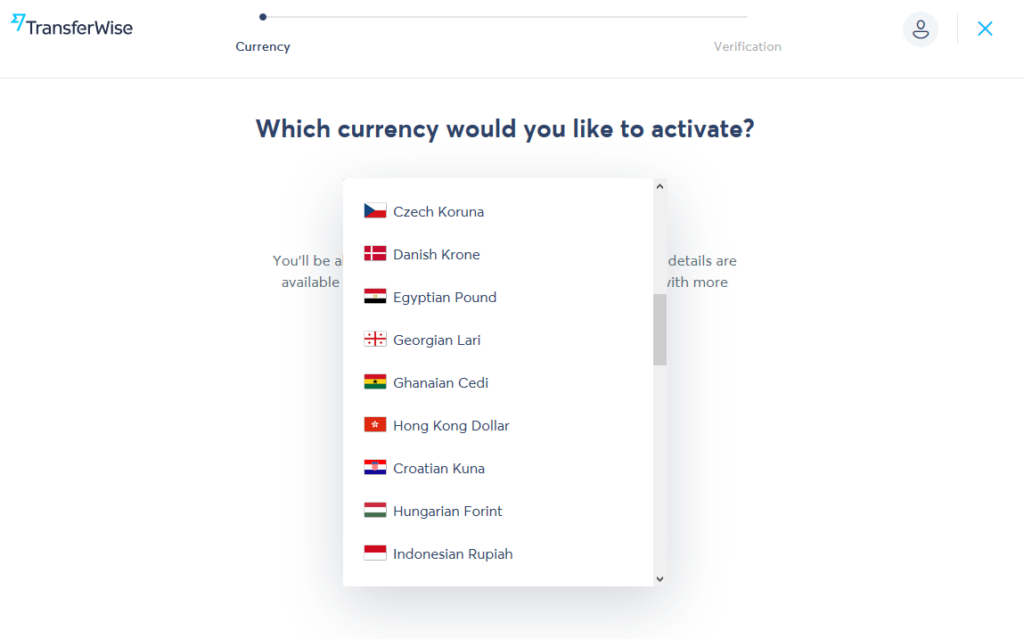

In 2017 Wise introduced their Borderless Account, which offers an account similar to a bank account, which seamlessly handles multiple currencies. The Borderless Account enables you to have a separate account in each currency (over 40 available).

Once you have a Wise Borderless Account, it’s easy to activate a currency.

You can receive payments in any of four currencies (EUR, USD, GBP, AUD) into accounts dominated in these currencies.

The accounts each have local receiving details (ACH routing for USD – SEPA IBAN for Euros etc.), so for people making payments from countries with these currencies, it’s a local transaction.

Foreign Currency Bank Account

So for example, if an investor wanted to invest with a UK peer-to-peer lender who required a UK bank account in GBP, he could use his GBP denominated Wise Borderless Account to move money between the Peer to Peer lenders bank and his own bank.

And of course, if you need to do currency exchange, Wise is an expert, and happy to help with that at very low rates. For the latest stories follow Bangkok Jack News on Twitter.

The same thing applies to people who maybe need to move money to or from US companies, they appear to have a US bank account and can do ACH or domestic wire transfers in to or from their Borderless Account.

Major Benefits

There are many specific benefits to using a Borderless Account. Many online marketplaces that are geared to specific countries can suddenly become accessible to account holders.

For location-independent workers, expats and others, this latter feature can make doing business vastly easier for two main reasons.

The first is that using traditional means of transferring funds internationally to businesses or individuals was expensive.

In many cases, the Borderless Account significantly decrease those fees and transit times versus using other means of international money transfers.

There are no monthly or recurring fees for holding and operating a Borderless Account beyond the fees incurred with the transactions themselves.

The second way in which a Borderless Account can greatly simplify things for international freelancers is the simple fact that many companies require local banking information to use their services at all.

For example, many U.S.-based freelancing sites require customers to have a U.S. bank account in order to be paid. Without a Borderless Account, those freelancers may find it difficult or impossible to work with such companies at all.

Borderless Accounts are available to people who live most places throughout the world. However, there are some countries where opening a Borderless Account is not currently possible. These include Hong Kong, Japan, India, and many others.

For a complete list of places where it is not currently possible to open a Borderless Account, see here.

Also, virtual bank accounts can currently only be issued to emulate accounts in the United States, the eurozone, Great Britain, New Zealand and Australia.

In an age where many banks are charging serious overt and hidden fees to their customers merely for the privilege of having an account, the prospect of a truly free online account is a welcome one.